Climate Change Initiatives and Information Disclosure

Based on the IFRS Sustainability Disclosure Standards

■TOC■(Click the following each content to jump.) Basic Concept |

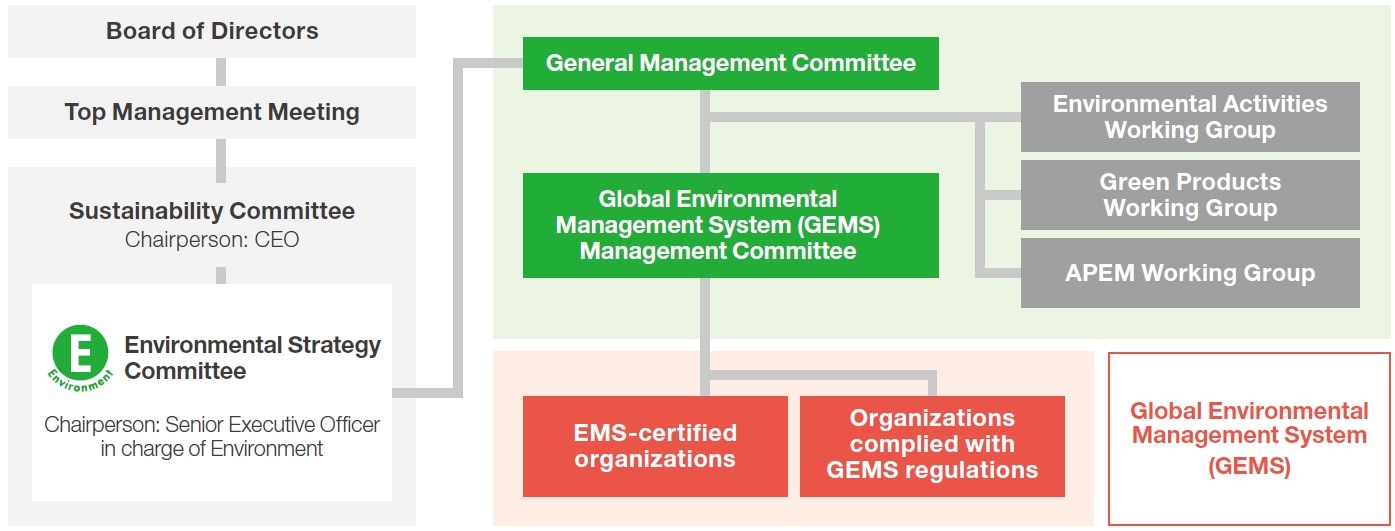

Departments responding to climate change and each role

| Name | Function | Number of Meeting |

| Board of Directors | Supervision of important matters related to climate change | 7 times per year* |

| Top Management Meeting | Decision making of important matters related to climate change | 8 times per year* |

| Sustainability Committee | Review of important items relating to climate change, and submission of those to the Top Management Meeting | Twice a year |

| Environmental Strategy Committee | Management of climate-related opportunities | Once a month |

| Risk Management Committee | Management of climate-related risks | Twice a year |

| Executive Officer in charge | Senior Executive Officer in charge of the environment | |

| Responsible Department | Strategic Planning, Environmental Promotion, Accounting, CSR, HR&GA | |

| Back to the top of the page | |

StrategyThe IDEC Group regards environmental strategy as an integral part of its business strategy, and has incorporated eco-friendly products into its transition plan starting in FY2026 by introducing sales targets for eco-friendly products as KPIs. This will enable us to systematically improve the level of environmental contribution of our business activities. We are also accelerating the development of our value chain with suppliers by setting supply chain engagement rate as a KPI and revising CSR procurement and green procurement guidelines. In addition, we are continuously engaged in various environmental initiatives, including reducing CO2 emissions to achieve carbon neutrality, reducing industrial waste, and increasing recycling rates. These transition plan-related activities align with the IDEC Group's purpose of contributing to the realization of safety, ANSHIN, and well-being for people worldwide, as a harmonized approach to environmental considerations. In addition, ESG-related information, including disclosures based on the TCFD Recommendations, has been included in our Securities Report since of FY2024. | |

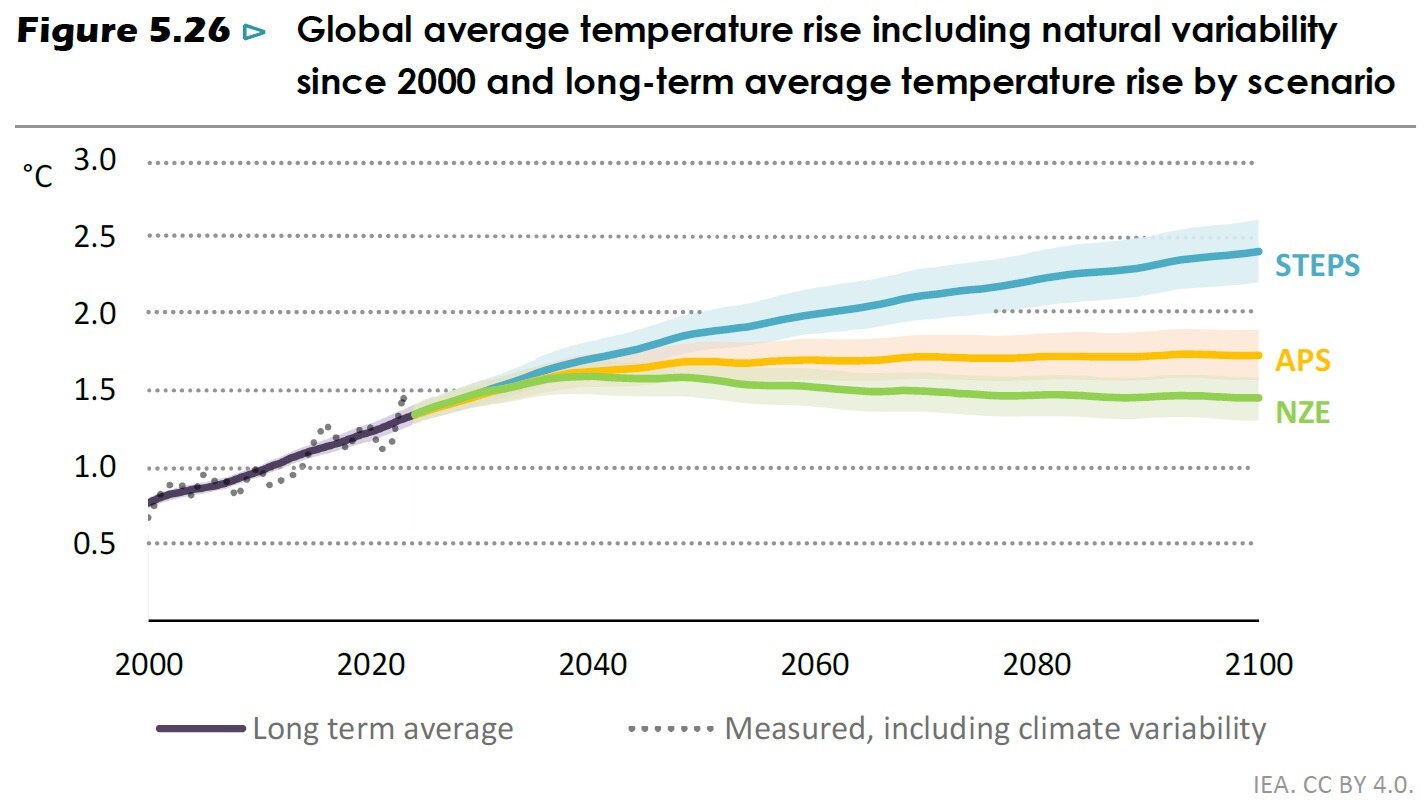

Climate resilienceThe World Energy Outlook 2024 (WEO2024) report published by the International Energy Agency states that due to global geopolitical tensions and divisions, the world faces energy security risks, which pose major risks to concerted efforts to reduce emissions. While geopolitical risks abound, the report explains that the fundamental balance of the market is loosening, setting the stage for fierce competition between different fuels and technologies. Momentum for clean energy remains strong and is expected to lead to a peak in demand for various fossil fuels by 2030. Based on these conditions, the IDEC Group’s selection scenarios for FY2025 are the same as in FY2024, and the transition risk scenarios are the WEO2024 STEPS (2.6°C scenario) and NZE (1.5°C scenario). For our physical risk scenarios, we adopt RCP2.6 (2°C scenario) and RCP8.5 (4°C scenario) of the IPCC Fifth Assessment Report. | |

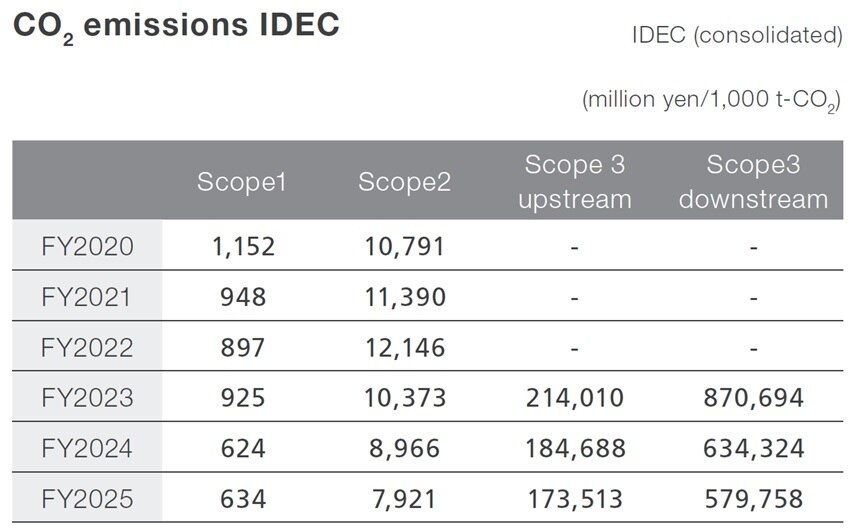

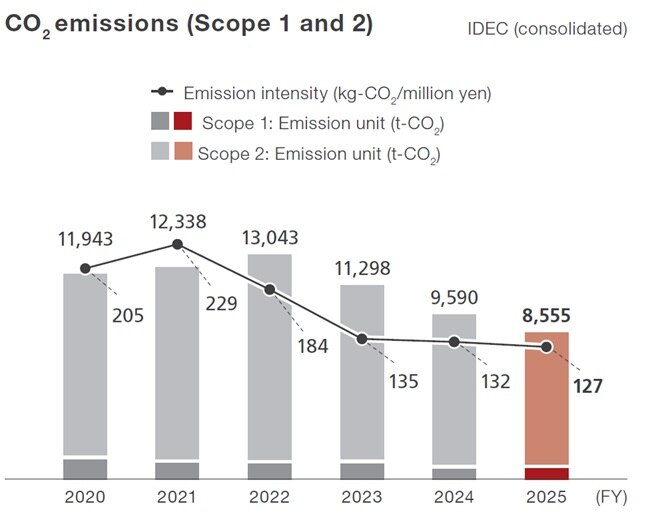

Energy-related CO2 emissions

| |

Based on our selected scenarios, we held workshops at IDEC head office and GEMS Steering Committee members’ countries and regions in FY2025 to analyze risks and opportunities together with team members from various departments. In our workshops, we used the International Energy Agency's World Energy Outlook 2024 (WEO2024), IFRS S2 and industry-specific disclosure topics, CSRD/ESRS, and the Materiality Assessment Implementation Guidance (MAIG) as reference materials for risk and opportunity assessments. Findings were categorized into transition and physical risks, time-related impacts, and potential financial impacts, and organized into our 1.5°C/2°C and 4°C scenarios. | |

| |

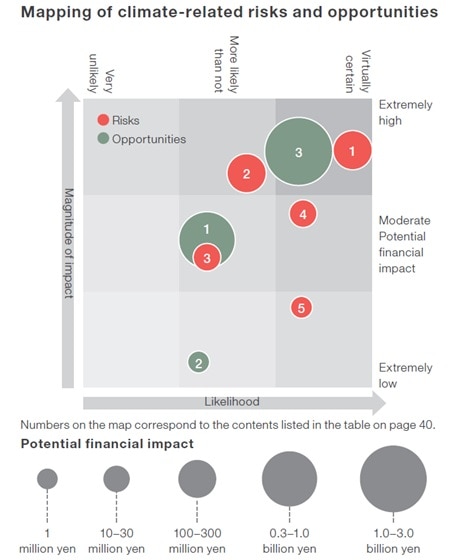

Risk ManagementFor each of the climate-related risks and opportunities identified by the Environmental Strategy Committee, we considered the likelihood of occurrence, degree of impact, and amount of potential financial impact, and compiled them into a risk and opportunity map. The identified results and risk items that have been assessed as important in our mapping are managed by referring to an integrated risk map for the IDEC Group. They are also reflected in the risks and opportunities associated with natural capital, one of our materialities. The Environment Promotion Department lists environmental risk management items on an annual risk management table, specifies performance indicators, and reports the state of achievement to the Risk Monitoring Subcommittee. | |

Strategy: Climate change risks and opportunitiesBased on our scenarios and other findings from risk and opportunity workshops conducted in Japan and other countries participating in the Global Environmental Management System, we identified transitions and physical risks and opportunities reasonably expected to have an impact on IDEC Group's outlook. Next, we calculated the probability of occurrence, degree of impact, and potential financial impact for each risk and opportunity item, and updated our climate-related risk and opportunity map. Details summarizing the potential financial impacts of risks and opportunities and measures to address them is scheduled to be disclosed later. Descriptions of risk items Descriptions of opportunity items The world images assumed in each scenario are summarized as below. |  |

The Image of the world in +1.5℃ and 2℃

| Transition Risks | Great increase carbon tax (carbon price) Enhance limitation of using restricted substances and energy Introduce environmental tax |

| Opportunities associated with Transition | Business opportunity for new energy Develop Carbon dioxide Capture and Storage (CCS) technology (land and ocean) Increase the dealing in the carbon credit Expand business of energy saving and recycling |

| Physical Risks | Increase temperature (+2.0℃) Increase the frequency of occurring disasters, expand the scale of disasters Increase the amount of rainfall |

The Image of the world in +4℃

| Transition Risk | Increase movement restriction |

| Opportunities associated with Transition | Develop and prevail protective clothing for environment Promote automation (robotics) Mitigate carbon tax and regulations Increase options for available energies Activate business of manufacturing substitute food (genetically modified food) Change in working style |

| Physical Risks | Great increase temperature (+4.0℃) Increase the scale of disasters occurred, great expand the scale of disasters Great increase the amount of rainfall Great rise the sea level Occur and expand unknown infectious diseases Food crisis Water shortage due to the expansion of desert Change in fishing grounds Increase ultraviolet rays |

Risks and Opportunities

In an effort led primarily by the Environmental Strategy Committee, we have identified risks and opportunities that could reasonably be expected to affect the outlook of the IDEC Group in reference to the risks and opportunities items of the CDP Climate Change Questionnaires, one of the global standards for environmental information disclosure. Referring to and considering the applicability of the industry-specific disclosure topic (Electrical & Electronic Equipment industry) as defined in the IFRS S2 Industry-based disclosure requirements, we identified transition risks and physical risks, impacts of climate-related risks and opportunities that can reasonably be expected to occur over any short to long-term period, potential financial impacts, and defined timeframes.

Major Risks List

Category | Number | Item | Potential financial impact | Responses | |

Transition risk | Market | ❶ | Increase in material costs | B/E | ・Transfer costs in response to price increases by continuously mutual understanding with suppliers and customers. |

| ❷ | Growing environmental awareness among customers and investors | C/D | ・Position environmental strategy as one of the priority items in the medium- to long-term plan, set materiality KPIs relating to the environment, such as increasing the cumulative ratio of enhanced eco-friendly products among new products, and check progress. | ||

| Technology | ❸ | Delay relative to competitors in the transition of existing and new products to low-emission/low-carbon technologies | C | ・Systematically incorporate technologies that we do not have and integrate them with our core technologies through long-term collaboration with other companies. | |

Current regulations | ❹ | Tendency of carbon pricing | B/E | ・Reduce the impact of rising energy purchase prices through the planned introduction of self-consuming renewable energy. | |

Physical Risk | Urgent/ | ❺ | Natural disasters (heavy rain, hail, snow/ice, cyclones, hurricanes, typhoons, floods, inundation, earthquakes) and temperature rise | D | ・Enhance BCP measures to enforce the company’s resilience. |

A: Increase in direct costs B: Increase in direct and indirect costs C: Reduced sales due to decreased demand for products and services D: Reduced sales due to decreased production capacity E: Increase in capital expenditure

Major Opportunities List

Category | Number | Item | Potential financial impact | Responses | |

Resource | ❶ | Demand for low-emission products and a diverse variety of new products and services through R&D and technological innovation | A/B | ・Accelerate technology innovation of flagship products based on environmental aspects as well. | |

| Shifting consumer preferences | B | ||||

| ❷ | Shift to alternative materials /diversification / new technologies | B | ・Breakaway from prolongation of our conventional technologies. | ||

Products | ❸ | Transition to distributed energy generation and new market entry | A | ・Innovate our environmental business, using the response as an opportunity. | |

| Participate in the renewable energy program and adapt to energy-saving measures. | |||||

A: Increased sales through entry into new and developing markets B: Increased sales as a result of increased demand for products and services C: Reduction of indirect costs (operating expenses)

|  | |

Back to the top of the page Back to the top of the page | ||

Information disclosure in the EU (APEM, France)APEM—which operates mainly in EMEA as the IDEC Group—has established a team to work on the requirements of the Corporate Sustainability Reporting Directive (CSRD) and is preparing for the disclosure in 2028. APEM has responded to EcoVadis, which the IDEC Group has addressed since FY2023, as a non-consolidated Group company in Europe, and is taking various measures to establish double materiality that will be required in the future. Back to the top of the page | ||