Remuneration Policy for Directors

At the general meeting of shareholders held on June 16, 2023, we reviewed the remuneration system for directors, and from FY2024, the remuneration system will be as follows.

1. Basic policy

In order to ensure that remuneration for the Company’s directors (excl. outside directors and directors who are Audit and Supervisory Committee Members) functions sufficiently as an incentive for the sustainable improvement of corporate value, when determining the remuneration of each director, basic remuneration, performance-linked remuneration (bonus) and non-monetary remuneration (stock-based remuneration) shall be paid as fixed remuneration in accordance with their responsibilities in consideration of the scope and scale of management.

Outside directors and directors who are Audit and Supervisory Committee Members receive only base remuneration as fixed remuneration because they are responsible for supervising the management of the Company from an independent perspective.

2. Policy for determining the amount of basic remuneration (monetary remuneration) for each individual (including policy for determining the timing and conditions for granting remuneration)

The basic remuneration for the Company’s directors is fixed monthly remuneration, which is determined by comprehensively taking into account the position, responsibilities and financial situation of the Company.

3. Policy for determining the details of performance-linked remuneration, etc., and non-monetary remuneration, as well as the number or calculation method (including policy for determining the timing and conditions for granting remuneration)

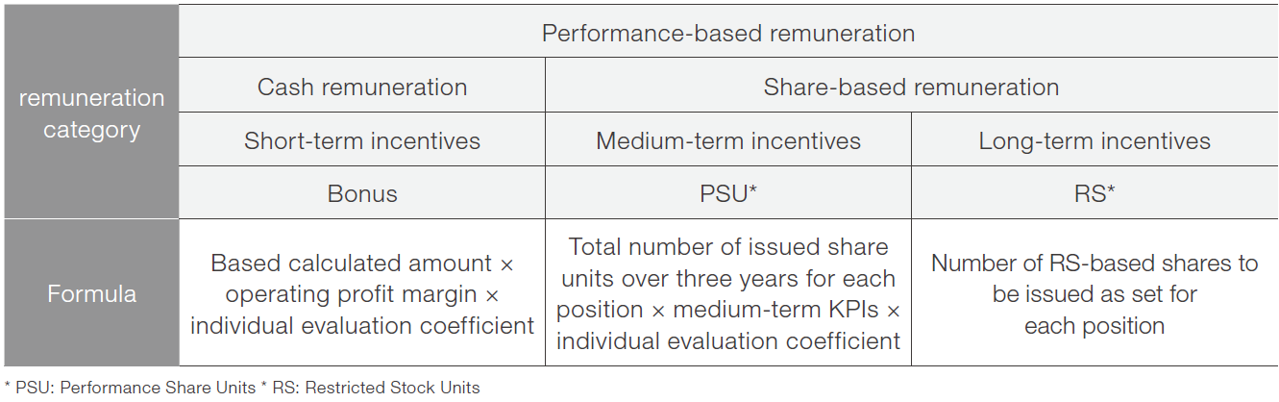

(1) Performance-linked remuneration (bonus)

In addition to the monthly basic remuneration, bonuses are paid monthly in 12 equal installments as performance-linked cash remuneration that reflects Key Performance Indicators (KPI), in order to raise awareness of improving performance each fiscal year and to clarify commitments to stakeholders on these matters.

The Company shall calculate bonuses by multiplying the base amount for bonus calculation specified for each officer based on the Company performance payment factor (0% to 200%).

The KPIs used for the calculation of bonuses shall be the consolidated operating profit ratio for each fiscal year and personnel evaluations related to performance, etc., for the departments they are in charge of (excl. exective directors).

(2) Non-monetary remuneration (stock-based remuneration)

■Details of stock-based remuneration

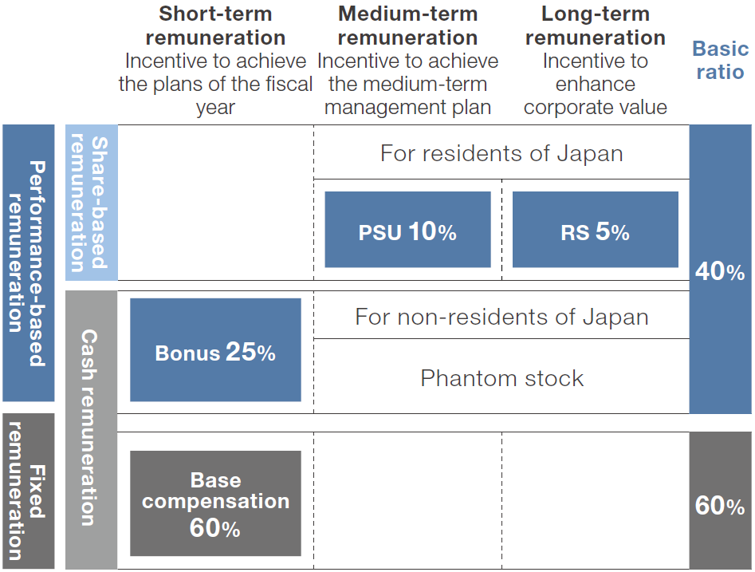

Stock-based remuneration consists of performance share units (hereinafter, PSU) as a medium-term incentive and restricted stock (hereinafter, RS) as a long-term incentive.

Share units and ordinary shares (with restrictions on transfer) calculated in accordance with the position shall be allotted annually at a fixed time.

If a director is a non-resident at the time of granting stock-based remuneration, an equivalent amount of phantom stock shall be granted instead of PSU and RS.

■Policy for determining the calculation method for numbers

・As for PSU, the Company shall issue shares of common stock of the Company with transfer restrictions in accordance with the number of fixed share units, which is calculated by multiplying the share units granted for each position by the payment factor corresponding to the degree of achievement of financial indicators and non-financial indicators, which are emphasized in the Medium-term Management Plan (1 share unit = 1 common share).

・The KPIs used to calculate PSU shall be the degree of achievement of the targets set forth in the Medium-term Management Plan as financial indicators, the degree of achievement of ESG-related targets as non-financial indicators, and personnel evaluations related to performance, etc., for the departments they are in charge of (excl. exective directors)

・As for RS, the Company shall allocate shares of common stock of the Company with transfer restrictions in a number equal to the base amount annually at a fixed time, determined in light of the business results of the Company, the scope of responsibilities of each director and various circumstances.

4. Policy for determining the ratio of monetary remuneration, performance-linked remuneration, etc., or non-monetary remuneration, etc., to the amount of remuneration, etc., for an individual director

The ratio of each type of remuneration for the Company’s directors (excl. outside directors and directors who are Audit and Supervisory Committee Members) shall be set at base remuneration, bonus, PSU and RS = 60:25:10:5, with reference to other companies in the same industry and of the same scale, and in consideration of the level of salaries, social conditions, etc., of the Company’s employees (This shall be the standard that serves as a guideline for achieving 100% of the performance targets).

The level of remuneration and the proportion of remuneration shall be reviewed based on a report from the Remuneration Committee, as appropriate, taking into consideration the Company’s business environment, social conditions and other circumstances.

5. Matters concerning determining the details of remunerations, etc., for each director individually

When determining individual remunerations, etc., the Remuneration Committee shall discuss, in addition to each position, the business performance for executive directors, the expertise and outside management experience for outside directors, etc., and report the details to the Board of Directors. Ultimately, the Board of Directors, the majority of which consists of independent outside directors, shall leave individual remuneration to the discretion of the Representative Director Chairman and President.

The Representative Director Chairman and President shall make their decisions on individual remuneration, etc., respecting the recommendations of the Remuneration Committee.

6. Repayment of remuneration, etc. (malus and clawback provision)

In case a director of the Company has committed any serious misconduct or violation, based on the recommendation by the Remuneration Committee, the Company shall demand the forfeiture or return of all or part of the bonus and stock-based remuneration.

Total Remuneration Limit

At the 71st Annual General Meeting of Shareholders held on June 15, 2018, it was approved that the maximum amount of remuneration for directors (excl. directors who are Audit and Supervisory Committee Members) would be 360 million yen per year (of that, up to 30 million yen per year for outside directors).

Recently, the Company has decided to review the remuneration structure for directors excluding directors who are Audit and Supervisory Committee Members and outside directors, with the aim of further promoting the enhancement of corporate value and the sharing of value with shareholders, and with the aim of ensuring that remuneration levels and incentives are sufficient to secure global talent, not only in Japan, from the perspective of strengthening the global management system.

In addition, the Company has decided to review the remuneration for outside directors, excluding directors who are Audit and Supervisory Committee Members and directors, with the aim of establishing an effective remuneration level to secure talented people for outside directors, taking into account various factors such as the increasing roles expected of outside directors and the recent social situation.

Therefore, the Company revised the total amount of monetary remuneration for directors (excl. directors who are Audit and Supervisory Committee Members) to no more than 700 million yen per year (of that, up to 50 million yen per year for outside directors).

Director Compensation for FY2025 (Fiscal year ended March 31, 2025)

| Category | Total amount of compensation, etc. | Basic remuneration | Total amount per type of compensation, etc. | Persons | ||

| Performance-based remuneration | ||||||

| Short-term incentives | Medium-term incentives | Long-term incentives | ||||

| Directors (excluding Audit & Supervisory Committee Members and Outside Directors) | 372 million yen | 241 million yen | 70 million yen | 42 million yen | 18 million yen | 4 |

| Directors (Audit & Supervisory Committee Members) (excluding Outside Directors) | ー | ー | ー | ー | ー | ー |

| Outside Directors | 52 million yen | 52 million yen | ー | ー | ー | 6 |